Table Of Content

Homeownership, on the other hand, can provide a feeling of stability and community. We are an independent, advertising-supported comparison service. Living there while renting out the main house is saving me about $2,200 each month. Buying a home is a huge decision, and picking the right mortgage is a huge part of that process! Here's why the 15-year fixed-rate mortgage might be one of your best options when it comes to buying a house.

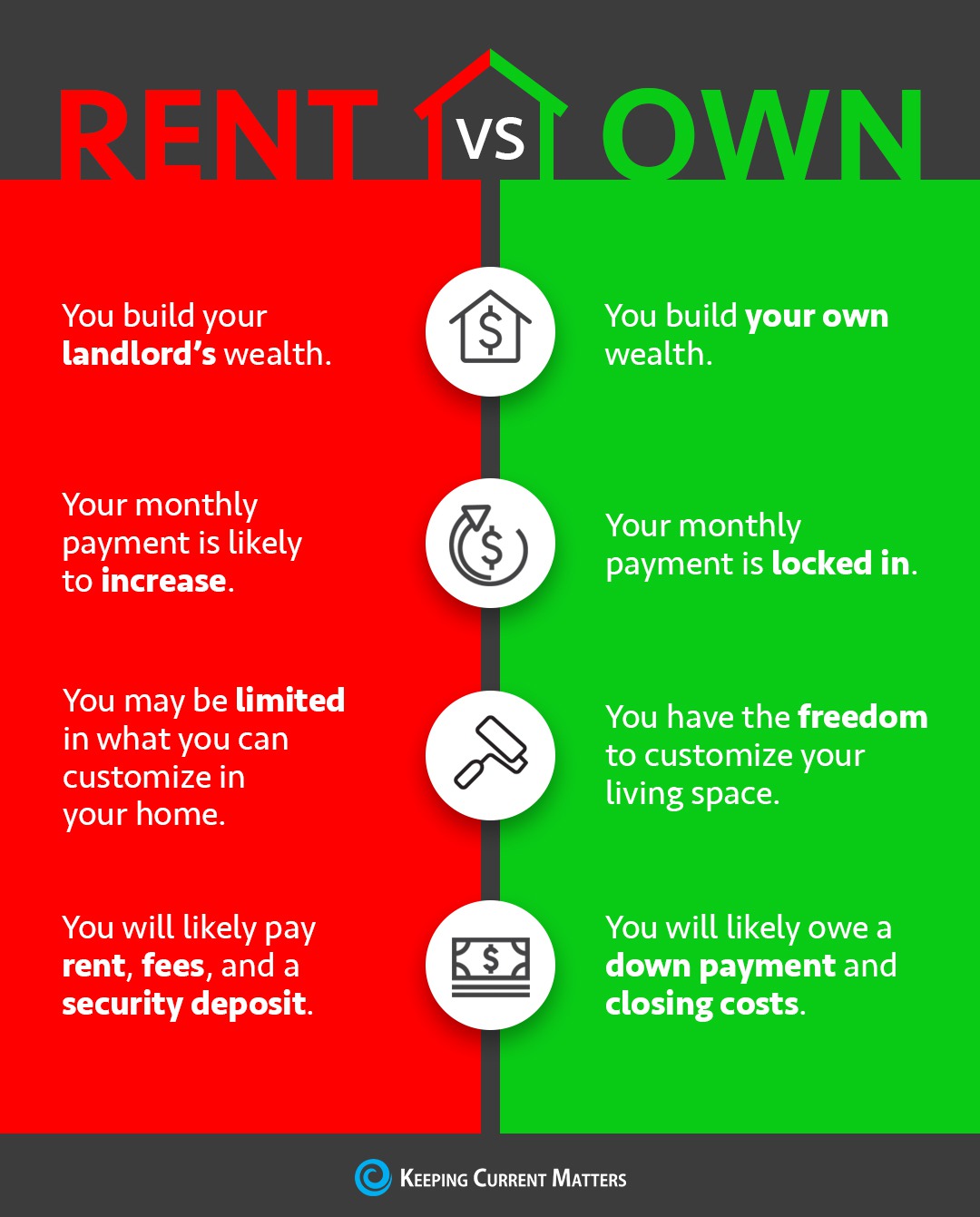

Benefits and drawbacks of renting a home

Keep in mind that while a 20 percent down payment is great for reducing monthly costs, it’s not always necessary. Smaller down payments are much more attainable, Olsen says. Home prices are soaring, and while interest rates for mortgages are down from their 2023 peaks, they’re still relatively high.

Maintenance costs

When it comes to real estate, you’re way better off buying the right home at the right time—not buying a house based solely on the market. When you do that, you run the risk of getting in over your head with a house you can’t truly afford. Sally Tunmer is a writer and content strategist with 10 years professional experience focusing on real estate, travel and the lifestyle and culture of places. She was the former editor of the official New Orleans tourism blog and is a regular contributor to neighborhoods.com. Sally is currently based in Atlanta where she drinks wine, listens to music and writes about both on her personal blog. Another way to look at building equity is that it’s a type of forced savings account.

Other financial benefits of buying a house

Cost of renters insurance as a percentage of monthly rent. New York real estate agent Lauren Hurwitz advises clients to think about how long they plan to stay in a home. If buyers are looking during an especially robust time, the length of their investment matters. Upfront costs are the costs you'll need to pay before moving into your new home, including your down payment, closing costs, and other fees. Each of us has a unique lifestyle, financial situation, and set of long-term life goals that impacts our decision whether to rent or buy a house. To sort this all out for yourself, consider three main questions.

And when you sell the house and move, the cost of the added square footage will likely be paid back, at least in part. Even if you make no major improvements, you will get more for the home than you paid in the form of equity since most real estate appreciates in value over the years. The upfront cost of buying a home is the biggest barrier for many would-be buyers. In addition to a down payment, you’ll need to save for closing costs, which will run you about 3% to 5% of the loan amount. To make things easy, we made a number of assumptions about other typical costs that factor into this calculation.

Insurance

If monthly mortgage payments would be a financial strain, it could be better to keep renting for now. Maybe you’re ready to move out of your rental and into your own home. Or perhaps you’re relocating to a new city and contemplating whether to rent a home before making the leap to homeownership. Whatever your reasons, take a moment to consider how renting vs. buying a home will affect your life now and in the future. Deciding between renting and buying a home isn’t just about cost — the decision also involves long-term financial strategies and personal circumstances.

On the other hand, if you've found a community where you'd like to put down roots, buying may be the better option. For example, the mortgage interest deduction allows you to deduct any interest paid on your mortgage that year from your taxable income. Owning a home isn’t automatically better than renting, and both options provide you with stability and a place to live.

Renting vs. owning: What’s the difference?

Most experts say tenure is the most important factor when deciding between renting and buying. If you and your family do not plan to stay where you are longer than 3 years, you would be better off renting for now according to most experts. If you are not sure, the pointer still leans toward renting. If you are committed to at least 3 to 5 years or more, it’s probably in your interest to look into buying. Depending on the housing market and economic conditions, this typically happens between years 3 and 5 of home ownership.

Property Values

"Renting provides some of that flexibility in life," says Stapp. Living in a rental allows people to make quicker changes to their lifestyle or to move for better job opportunities. Your rent payment is the money you pay to your landlord each month.

Is it cheaper to rent or buy in North Jersey? - NorthJersey.com

Is it cheaper to rent or buy in North Jersey?.

Posted: Tue, 30 Apr 2024 08:35:42 GMT [source]

Although I received the $40,000 grant, I had to borrow the rest of the money from my lender. As a result, my mortgage, including my main house and ADU, increased by $1,500 a month — from $1,200 to $2,700. In late 2022, The Real Deal reported that institutional investors set a staggering $110 billion aside to purchase or build single-family rentals. Should the rule pass, corporations would have to sell off all of the single-family homes they own over a 10-year period, at which point they would be barred from owning that type of property entirely. With money flowing in from his rental business and no rent to pay, Gordon invested heavily in stocks and cryptocurrency.

She Wanted a Brooklyn One-Bedroom for Less Than $500000. But Where? - The New York Times

She Wanted a Brooklyn One-Bedroom for Less Than $500000. But Where?.

Posted: Thu, 02 May 2024 09:06:54 GMT [source]

City Council lifted a moratorium on towing oversize vehicles used as homes, but the city doesn’t have enough trucks capable of removing RVs or enough space to store them. Gordon is affable and easygoing, hugging his visitors and laughing during every conversation. He’s quick to crack a joke while describing his often-tenuous living situations. At the dog park, he turned strangers into fast friends, joining regulars for dinner and even serving as a pallbearer at one of their funerals. Two of them were lemons, requiring more work to fix than he’d anticipated, but the third was good enough to drive around and sleep in.

In order to remain where you are, you must continue to pay rent, which typically goes up on a yearly basis. Initial costs are the things you need to pay when you first move into a new place. When buying, these costs are going to be much higher than renting, so you should consider if you have the money to cover them before buying. For buyers, these costs include down payment and closing costs which are often around 24% of the total purchase price. When renting, this is typically just your security deposit which is usually equal to one months rent.

Or you could buy a house in a different part of town where prices are more affordable—but you’ll compromise on schools or your commute to work. Renting allows for more flexibility and has lower upfront costs. Without a down payment or closing costs, you can keep more of your cash on hand and invest what you would’ve put toward a house into the stock market. Another perk is that your landlord is financially responsible for any maintenance or repairs.

If something breaks down, as the homeowner you have to fix it. See Redfin's rental affordability calculator to learn what you can afford. While competition has calmed down somewhat this year, buyers often still have to make multiple offers on homes before they get one accepted.

No comments:

Post a Comment